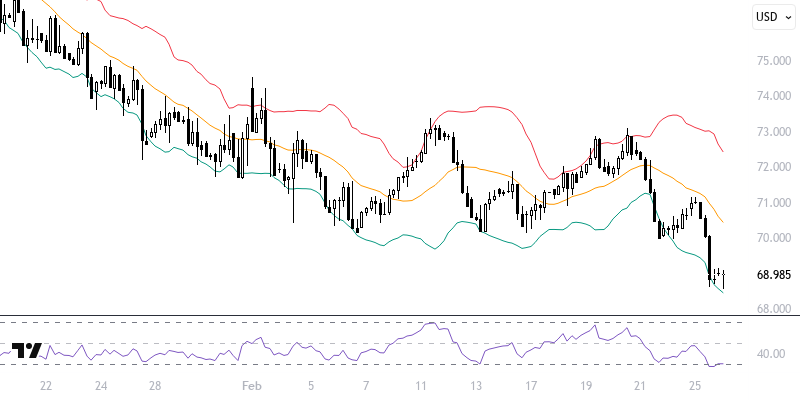

WTIUSD

Oil futures showed a downward trend due to expectations of weakness in global demand, with the situation being exacerbated by the involvement of the United States. While a search for balance was observed during the Asian session, the decline in consumer confidence in the U.S. to its lowest levels since April 2024 provided supporting data for this situation. Additionally, the potential for an agreement regarding Ukraine raised concerns about the possible return of Russian oil to the global market, which could put pressure on supply.

The American Petroleum Institute's report of a decline in oil stocks for the first time since the first week of January served as a factor limiting losses. As long as prices remain below the resistance levels of 69.50 – 70.00, the downward trend may continue. In the event of a decline, levels of 68.50 and 68.00 can be targeted, while closes above 70.00 could create new upward potential.

Support :

Resistance :