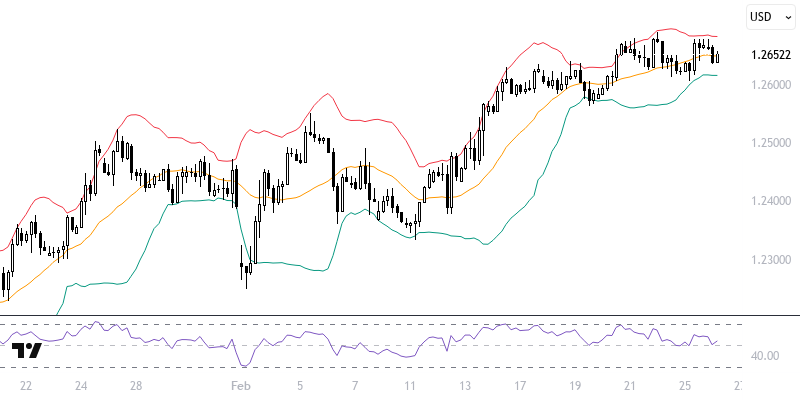

GBPUSD

The classic Dollar index continues to trade within a narrow range, causing EURUSD and GBPUSD pairs to exhibit a calm trend. Significant data regarding growth, employment, inflation, and central bank decisions is expected until March 20. During this period, asset prices are anticipated to be influenced by critical developments. With the new week, a more intense flow of data is expected. Today, the speeches of Fed officials Barkin and Bostic, along with the New Home Sales data, may serve as important points of interest.

While the GBPUSD pair moves between 1.2570 and 1.2620, it is attempting to maintain a short-term positive trend, particularly considering 1.2620 as a support level. Sustaining above this level could support a movement towards targets of 1.2675, 1.2715, and 1.2760. However, if the reference zone breaks downward, optimism in the 1.2510 – 1.2525 area will continue. The key levels for the day are identified as 1.2570 and 1.2675.

Support :

Resistance :