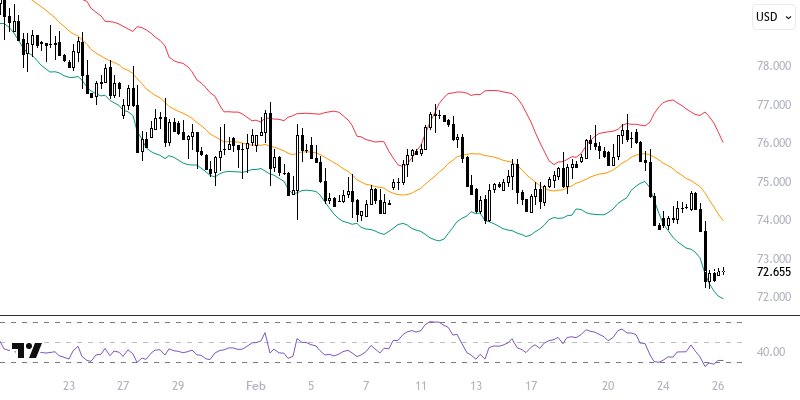

BRNUSD

Oil futures have declined as expectations of weak global demand also encompass the U.S. Attention is drawn to the search for equilibrium in prices during the Asian session. Data showing that consumer confidence in the U.S. has fallen to its lowest level since April 2024 supports this situation in the markets. Additionally, concerns that a possible agreement regarding Ukraine could reintroduce Russian oil to the world market are putting pressure on the supply side. The announcement by the American Petroleum Institute that stock levels have dropped for the first time since the beginning of January served as a factor limiting losses.

As long as prices remain below the resistance level of 73.00 – 73.50, a downward trend may persist. If declines occur, the levels of 72.00 and 71.50 could be targeted. In any potential recoveries, maintaining the resistance level of 73.00 – 73.50 could create new downside potential. Therefore, for the continuation of the upward trend, closes above 73.50 should be monitored; in this case, levels of 74.00 and 74.50 may come into play. The key level of the day: 73.00 – 73.50.

Support :

Resistance :