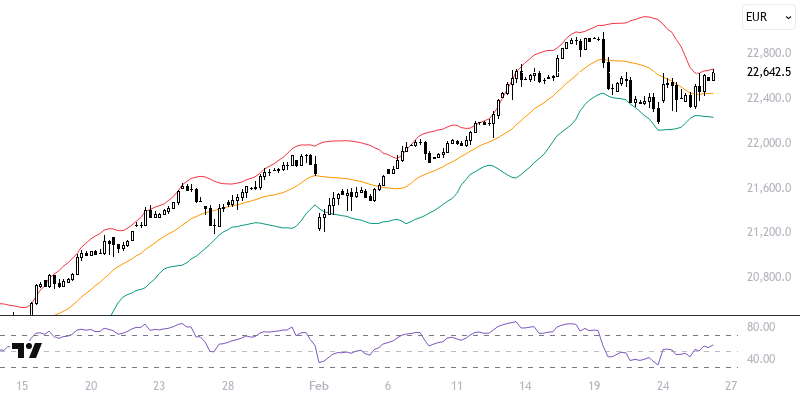

DAXEUR

European stock indices continue to attract attention with their impressive performance since the beginning of the year. Although this week has shown a mixed outlook, European markets (excluding France) have managed to maintain their optimism. While significant declines occurred in the EMEA region and Asia faced pressure with the U.S. accelerating its realization process, the Netherlands stands out with a performance exceeding 2%. Germany's DAX40 index, on the other hand, limited the flow of movement with a 0.55% increase.

The technical analysis of the DAX40 index indicates that the corrective process starting from the 23000 peak has not become permanent below the 21 and 55-period averages. These averages provide critical support for the continuation of the index's optimism. In terms of pricing, as long as it remains above the 22215 – 22535 range, there is an expectation to reach the 23000 peak again. The 22680 barrier is an important follow-up point for reaction sales or trend rallies. A permanence below 22215 could indicate a potential trend change.

Support :

Resistance :