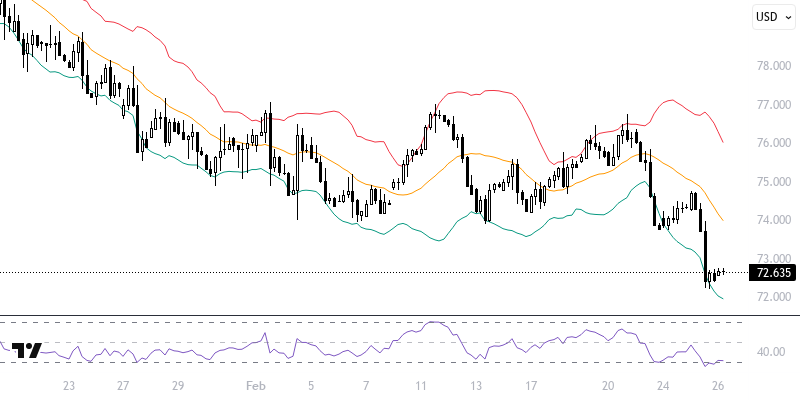

BRNUSD

Crude oil futures continue to decline as expectations of weakness in global demand combine with factors from the U.S. During the Asian session, a search for some balance persists, while the lowest consumer confidence data in the U.S. since April 2024 reinforces this situation. Additionally, a potential agreement in Ukraine that could allow Russian oil back into the world market is putting pressure on the supply side. The American Petroleum Institute's first announcement of a stock decline since the first week of January stands out as a factor that limits losses.

Throughout the day, the development of European and U.S. stock markets and the inventory data to be released by the U.S. Energy Information Administration should be monitored. Prices may maintain a downward trend as long as they remain below the resistance level of 73.00 - 73.50. In possible declines, the levels of 72.00 and 71.50 may be targeted, while closures above 73.50 could create new upward potential.

Support :

Resistance :