NDXUSD

President Trump's customs tax plans and foreign policy are increasing downward pressure on the NASDAQ100 Index. Following the approval of tariffs for Canada and Mexico, the executive order signed by Trump to review copper tariffs continues to create uncertainty in the market. Nevertheless, declines in the 10-year Treasury yield are limiting the index's fall in futures trading. Additionally, important data such as the Conference Board consumer confidence and the Richmond Fed manufacturing index are expected to be announced during the day.

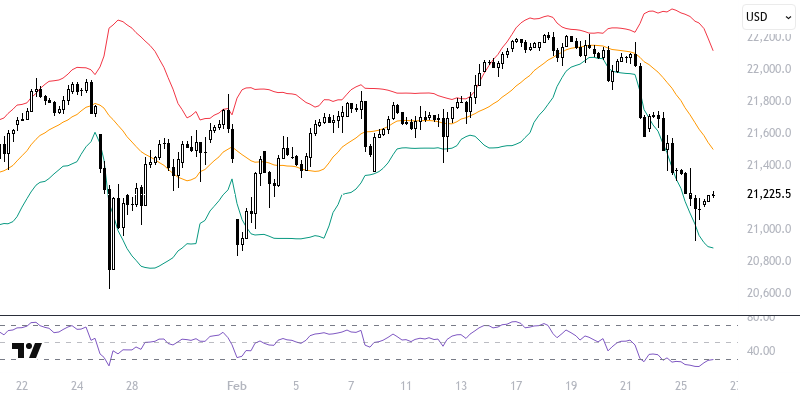

Currently, the NASDAQ100 index is trading below the support zone formed by the 21-period exponential moving average (21554) at the levels of 21500 – 21600 according to our technical analyses. Movements below this level may lead to a continuation of the negative trend. If the desire for pullback persists, a decline could occur towards 21200 and 21100 levels. However, for a positive outlook, sustained pricing above the 21500 – 21600 region will be necessary. In this case, levels of 21700 and 21820 may come into focus.

Support :

Resistance :