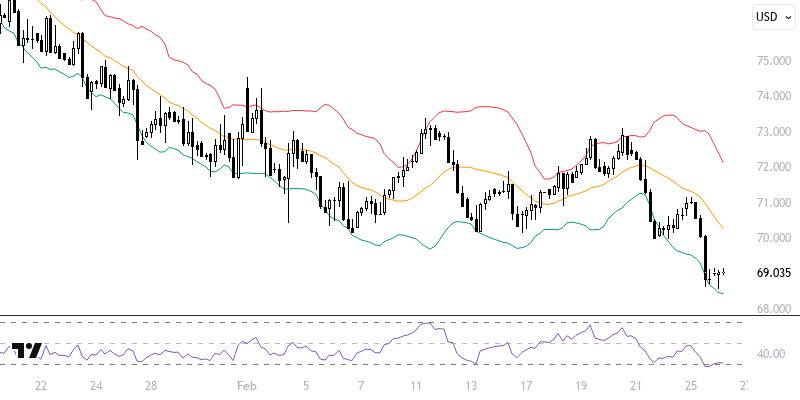

WTIUSD

Oil futures continue to decline, influenced by expectations of weakened global demand and contributions from the U.S. Although some efforts toward stabilization were observed during the Asian session, consumer confidence data in the U.S., which has been at its lowest levels since April 2024, reinforces this situation. Additionally, a potential agreement with Ukraine could lead to Russian oil re-entering the global market, creating supply-side pressures. The American Petroleum Institute's announcement of a decrease in stocks has also played a role in limiting losses.

As long as prices remain below the resistance levels of 69.50 - 70.00, a downward trend may be prominent. In case of declines, levels of 68.50 and 68.00 could be targeted, while any potential recoveries would require breaking the 69.50 - 70.00 resistance. It is critical to see daily closes above 70.00 for the continuation of upward momentum; in that case, levels of 70.50 and 71.00 could come into play.

Support :

Resistance :