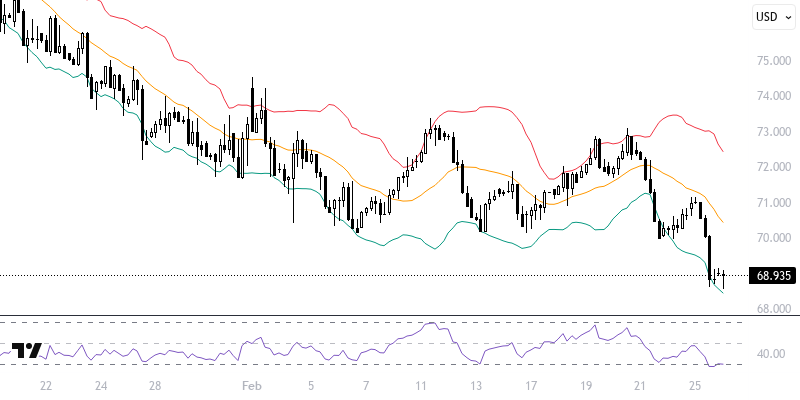

WTIUSD

Oil futures have declined as the U.S. shares expectations of weakness in global demand. During the Asian session, attempts to stabilize prices were observed. The U.S. consumer confidence data released yesterday reached its lowest level since April 2024, reinforcing this situation. Additionally, the possibility of an agreement with Ukraine that could bring Russian oil back to the global market has become another factor putting pressure on the supply side. The American Petroleum Institute's announcement of a drop in stocks for the first time since January emerged as a factor limiting losses.

As long as prices remain below the resistance level of 69.50 – 70.00, the downward trend may continue. In the event of a decline, levels of 68.50 and 68.00 could be targeted. For upward potential, movements and hourly closes above 70.00 should be monitored. In this scenario, levels of 70.50 and 71.00 may come into play. The critical level for the day is the range of 69.50 – 70.00.

Support :

Resistance :