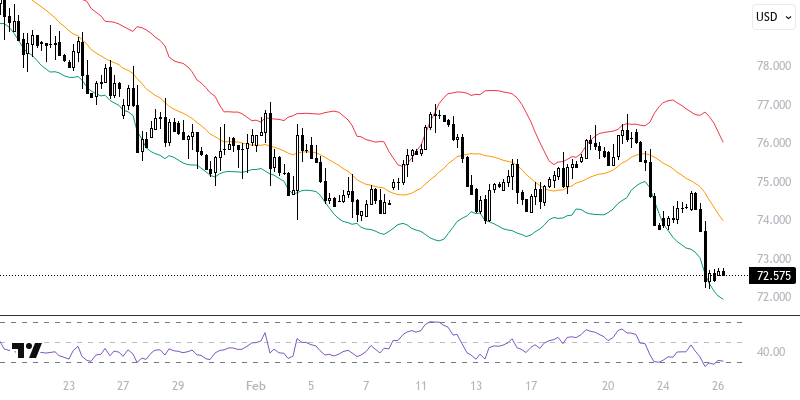

BRNUSD

Crude oil futures have declined as expectations of weak global demand also encompass the US. In the Asian session, an effort to find balance was observed, supported by the lowest consumer confidence data in the US since April 2024. Additionally, the likelihood of an agreement in Ukraine creating a pathway for Russian oil to re-enter the global market is exerting pressure on supply. The American Petroleum Institute's announcement of a stock decrease for the first time since January has helped limit losses.

As long as prices remain below the resistance levels of 73.00 – 73.50, the downward trend may remain prominent. In case of further declines, the levels of 72.00 and 71.50 could be targeted. On the other hand, if there is a recovery, maintaining the resistance at 73.00 – 73.50 could open up new potential for declines. Movements and hourly closes above 73.50 should be monitored for upward momentum, with potential targets of 74.00 and 74.50.

Support :

Resistance :